CREDIT CARD CHURNING

In the world of finance, the pain of repeatedly heavy transactions boils down to ease when it comes to credit cards. Credit cards offer you a line of credit that can be used to make purchases or cash advances requiring that you'll pay back the loan amount in future along with some minimum payments

In the world of finance, the pain of repeatedly heavy transactions boils down to ease when it comes to credit cards. Credit cards offer you a line of credit that can be used to make purchases or cash advances requiring that you'll pay back the loan amount in future along with some minimum payments that are required to be fulfilled every month within the due date. So now you see that even if you have a loose pocket, the weight of a credit card will prove to be heavier than many cash bundles.

BENEFITS

Also, applying for a credit card brings along with it many perks and rewards that, in general, heavily attract the public. Behind this bright picture of credit cards lies the dark image of credit card churning. Now, what's it all about?

In simple terms, credit card churning involves frequently applying for new credit cards, not necessarily to use or even keep them but rather to take advantage of lucrative sign-up or welcome bonuses in the form of cash or rewards miles or points and stop using them once the benefits are received. Credit card churners generally apply for multiple cards in a short period and then pause for several months to maximize the profit. By opening multiple credit cards, you can get a significant amount of reward points, cash back or airline miles within a short span.

DOWNSIDE

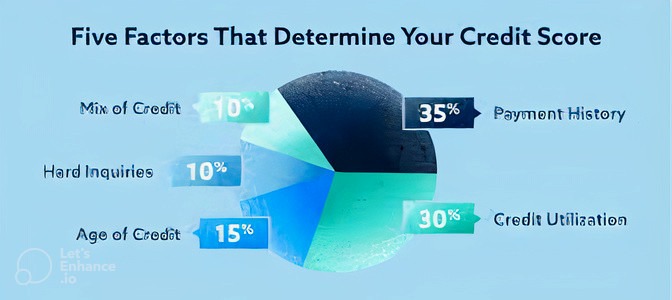

But all this is propitious to a person who knows the reward system well and is deeply learned of the credit system. The reason behind this is that if not acted carefully, credit card churning can negatively impact your credit score, credit utilization ratio, etc.

So talking firstly of the credit score, having multiple new accounts reflects impecuniousness or straitened circumstances. This eventually puts forth numerous questions in the minds of bureaus while considering your financial credibility. Aah, wait! Credit card companies aren't blockheads. They have put in place measures to avoid such activities and implemented policies to prevent people from signing into multiple accounts.

That being said, credit card churning will continue but not at the volume it was once.