COVID-19 and the Indian economy: Challenges and recoveries

2020, “The year of Turbulence,” will go down in history where everything went mayhem with the outbreak of the COVID-19 pandemic. The associated lockdowns drastically changed the essence of social outings globally. It is believed that the current crisis could be the most dominant economic crisis since the great depression of the 1930s, but 2021 gives us a ray of hope both in terms of vaccination of the people as well as recovery of economies worldwide, especially for large emerging economies like India.

2020, “The year of Turbulence,” will go down in history where everything went mayhem with the outbreak of the COVID-19 pandemic. The associated lockdowns drastically changed the essence of social outings globally. It is believed that the current crisis could be the most dominant economic crisis since the great depression of the 1930s, but 2021 gives us a ray of hope both in terms of vaccination of the people as well as recovery of economies worldwide, especially for large emerging economies like India.

Problems and challenges

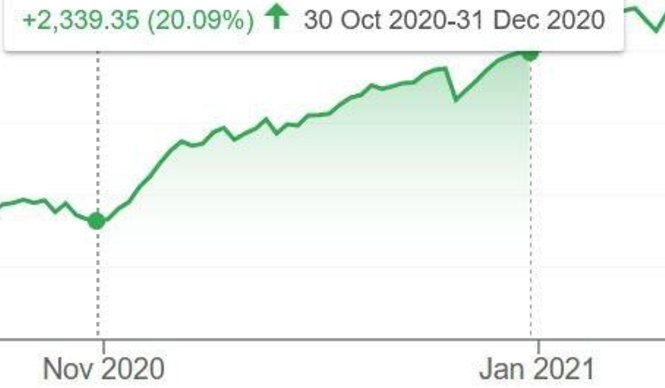

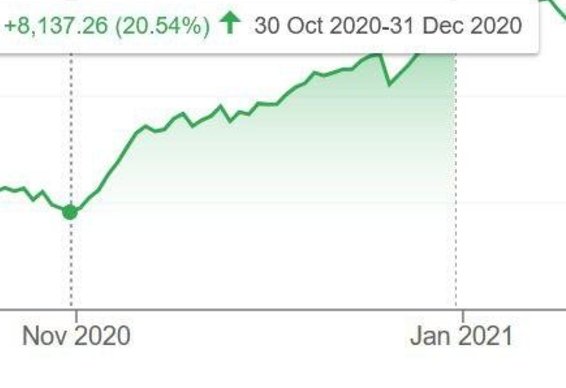

The current economic crisis is not caused by any financial irregularities or man-made conflict but due to a public health crisis. Economic recovery will go hand in hand with the development of an effective vaccine. For instance, when the news of the vaccine arrival broke out in early November, the stock market was on a bull run. SENSEX increased 20.54%(see Figure-2) while NIFTY rose 20.09%(see Figure-1) in just two months. The slowdown broke the supply side of the economy. Specifically, manufacturing was one of the worst-affected sectors in the initial phase of the pandemic. In India, the US$265 billion stimulus was provided for keeping the economy breathing, along the similar lines to what other countries have provided. But it is mostly indirect investing through social schemes and government projects rather than giving direct money, which would send inflation through the rooftop.

NIFTY-50(Figure-1)

SENSEX(Figure-2)

Another major problem for recovery is the growing distrust in globalization worldwide. After the 2008 global financial crisis, globalization started to recede, and the Covid-19 exaggerated it to a new extent. Many people believe that a new era belongs to nationalists and patriots, not to globalists. Still, it may be a constraint for an emerging economy like India that benefits significantly from capital inflows. GDP has also taken a hit this year, with losses going up to US$150 billion.

The Way Forward

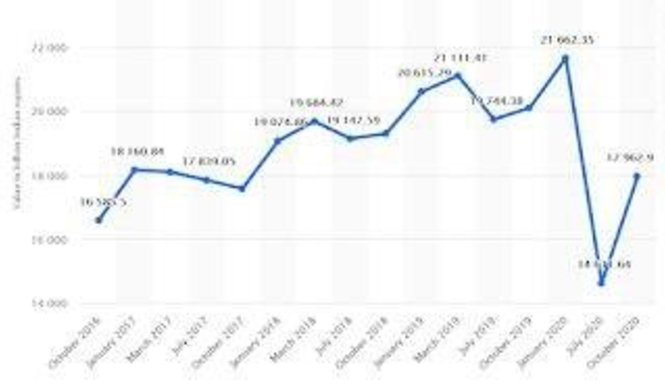

Investment in the public health system is an essential component of recovery; many socialist policies like universal health care, a minimum wage that came under scrutiny in a capitalist society, are considered; this depicts a significant economic shift visible in the coming years. The employment rate has also not returned to the pre-pandemic level and is still short by 12.4 million people(Figure-3). Hence, there is a need for certain corrective measures.

UNEMPLOYMENT RATE(figure-3, taken from CMIE)

Further, businesses and industries have to diversify their production to limit the effect of disruption, but with diversifying, the cost is likely to increase, which in turn could hasten a surge towards automation to restore profit margins. Digital presence is required for sustaining growth in the post-covid era. By going digital, people and businesses can perform their tasks respectively and communicate with each other without health concerns. These new behaviors will cement themselves into daily consumer and business life, supporting new industries and accelerating innovation in all sectors of the economy; fundamentals issues such as liquidity, cash flow, and risk management are keys for a good recovery.

Capital has to be generated, which can be achieved through the privatization of many PSU; in all major economies, most of the public sector units are owned by private firms, and all of them have become very successful. It generates higher-income jobs and better services for an equal amount of resources spent. Consumer spending still has not recovered fully from march; it dropped 32.5% in the first quarter of fiscal year 21 due to any movement restrictions. It increased by 22% in the second quarter but still short of the last quarter of FY21(see Figure-4). However, there is a need to boost consumer spending for a good recovery.

CONSUMER SPENDING(Figure-4, taken from Statista)

With reference to tax policies, one option could be a redistribution of tax brackets for individuals and corporations and some socialist approaches that have proven to be beneficial in times of an economic crisis like minimum wage, social security, universal health care have helped economies revive from “The Great Depression of the 1930s and 2008 Financial crisis” These schemes allow the government has to micromanage the economy for a swift and steady revival.

In conclusion, there is a growing optimism about 2021 that it will bring new opportunities and challenges. All we have to do is to learn the lesson from the pandemic and move on. While everybody wants to return to their pre-pandemic everyday life, a pragmatic approach would be crucial in the success of the recovery.