The emergence of health insurance sector in India

One of the biggest healthcare systems in the world, India has a potential beneficiary population of approximately 1.3 billion people. Since its inception in 1986, the health insurance market has expanded dramatically, mostly as a result of economic liberalization and increased public awareness.

One of the biggest healthcare systems in the world, India has a potential beneficiary population of approximately 1.3 billion people. Since its inception in 1986, the health insurance market has expanded dramatically, mostly as a result of economic liberalization and increased public awareness. Government-sponsored health insurance companies coexist with independent health insurers. Most prescription medications are now covered by the majority of comprehensive health insurance plans, which also cover the cost of normal, preventative, and emergency medical procedures.

India's healthcare system is undergoing a significant shift as a result of rising income levels, improved health awareness among the majority of classes, pricing liberalization, less bureaucracy, and the entrance of private healthcare finance. India has made significant progress in the area of health insurance during the past 50 years. Before independence, the health system was in poor shape, with high rates of morbidity, mortality, and the predominance of infectious illnesses. Since gaining our independence, we have placed a strong focus on primary healthcare, and we have achieved great strides in enhancing the nation's health. However, India continues to lag well behind several quickly emerging nations, like China, Vietnam, and Sri Lanka, in terms of health metrics.

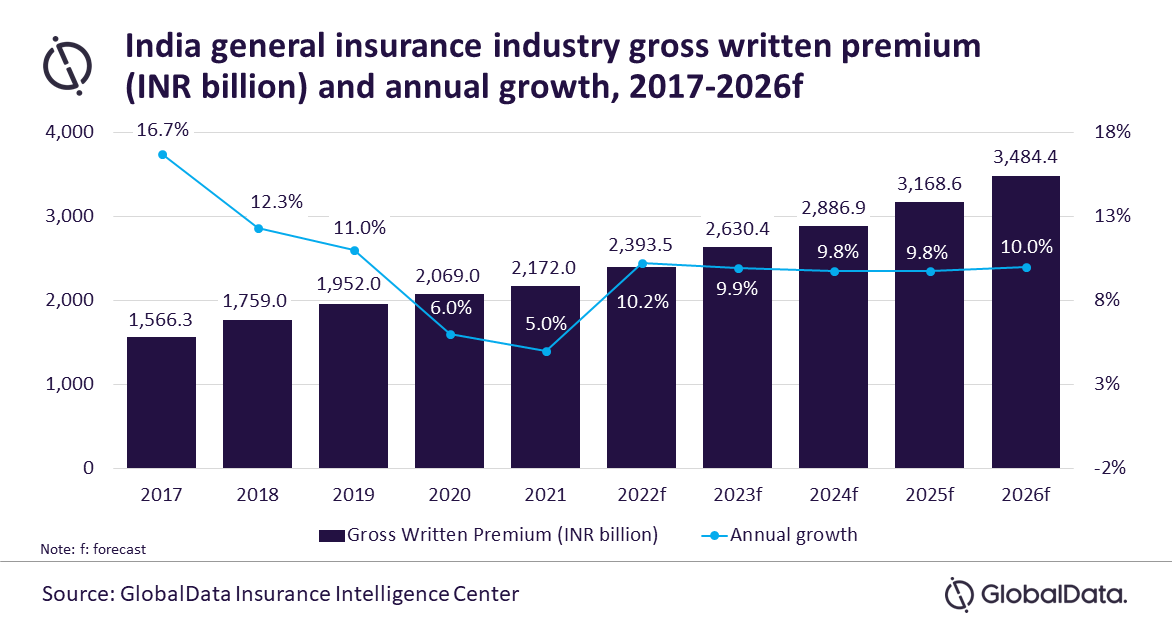

One of the key factors influencing the expansion of the general insurance market in India is health insurance. About 29 percent of India's entire general insurance premium income comes from it alone. From the standpoint of the general insurance industry's total expansion, this sector's growth is significant. Problems in this industry are many and are also harming performance at the same time.

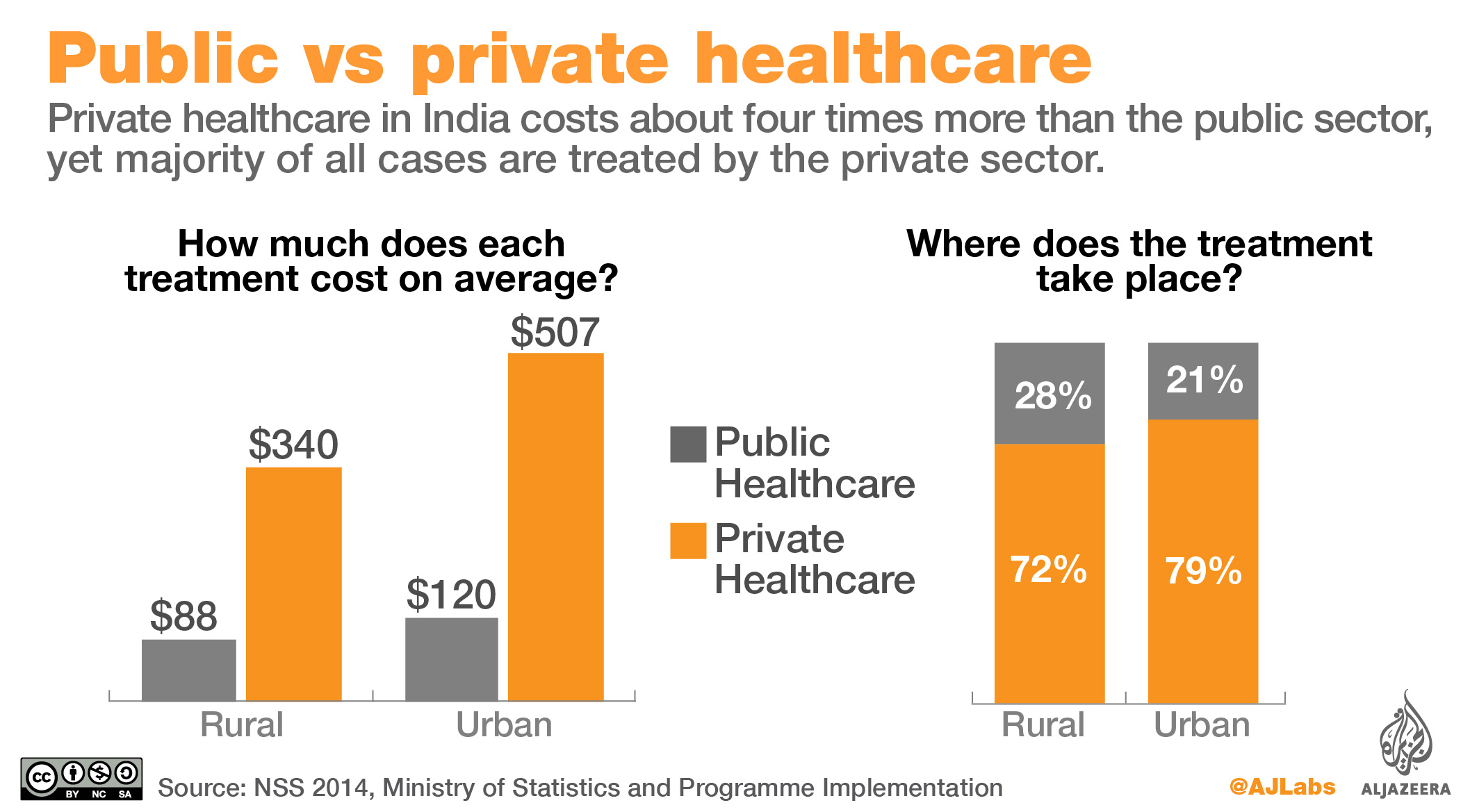

The availability of services and the state of health vary greatly between states. Although public health services in theory offer free basic healthcare to everyone, the majority of state health systems struggle to deliver care due to insufficient funding and bad administration. As a result, the majority of people use private health services, which are more expensive and give care that is of extremely variable quality.

The health care system in India combines governmental and private providers. Local clinics offering primary care, regional hospitals, and national hospitals are examples of public health institutions that are supported by federal states and the federal state and run by state officials. The availability of public health services varies significantly amongst federation states. Public health facilities serve as the starting point of the care process in some states, like Tamil Nadu or Kerala, but outside of these select few states, the public sector is unable to meet the population's fundamental health needs.

One of the key justifications for the establishment of health insurance that covers the most vulnerable people's hospital expenses is the financial load on the middle-class population of India. Health insurance is a structure that pays for or splits the costs of providing medical treatment. These programs fall under commercial health insurance, which is offered by public, private, and independent health insurance firms. Inpatient hospitalization and medical care are the only things that Indian health insurance normally covers. Under Indian health policies, outpatient services are not covered. Mediclaim Policy was the country of India's first health policy. The Indian government liberalized insurance in 2000 and welcomed private firms into the industry. With the emergence of private insurers in India, numerous cutting-edge products, including family floater plans, critical illness plans, hospital cash, and top-up policies, were introduced.

After the auto and life insurance sectors, health insurance is an emerging insurance market in India. The expansion of the health insurance industry in India is being driven by several key factors, including the rise of the middle class, rising hospitalization costs, costlier health care, digitization, and higher levels of awareness. Lifestyle diseases are becoming more prevalent. Our entire being has become sedentary. There is less physical labor now than there used to be, and there is no reason why this won't continue to be the trend. The implication is the emergence of chronic diseases caused by a sedentary lifestyle, like diabetes and cardiac issues. India's experience with health insurance programs dates back to the late 1940s and early 1950s when employees in the formal sector (Employees' State Insurance Scheme) and civil servants (Central Government Health Scheme) were enrolled in contributory but heavily subsidized health insurance programs. Since the early 1990s, the economy has been liberalized, and in 1999, the government opened up the private sector (including health insurance). As a result of this evolution, higher-income groups now have easier access to high-quality care from private tertiary care centers. One of the major benefits of health insurance for the tax-paying middle-class population is that the policyholder who takes out the insurance can claim tax deductions under Section 80D of the Income-tax Act. 25,000 for oneself, one's spouse, and any dependent kids and for parents, it is 50,000.

This industry is prone to claims, and there is constant pressure on its financial position. The IRDA has made a risky move by raising the premium for health insurance products. This will support the expansion of this industry. The health insurance industry in India has to turn around and begin to produce a profit with the help of superior technological know-how from overseas partners and the involvement of the IRDA. The COVID-19 epidemic presents a number of challenges for the health insurance sector while also giving insurers a chance to draw in new clients.